Our AML screening covers the following nodes:

PEP, OFAC, EU & Sanctions Lists

Quickly screen prospecting customer’s National issued ID card against in-house and government repositories in Ghana and selected West African Nations. Build a secure and trustworthy ecosystem by running a quick look up on our extremely responsive portal.

Use varied query strings and identifiers, including client’s phone number to retrieve a complete record on an interest person. Verifylab helps you reveal the person behind that phone number in a click with a concise report which aides in customer onboarding. Use our API or Portal based look-up channels to rid your systems of bad actors and help avert any suspicious acts.

All our profiles and references are structured and manually reviewed to ensure the

highest quality data. Our vast number of data points connected through our graph

network not only reveals sanction and PEP

individuals and companies but also unravels direct and indirect business, family,

and close associations. Our service ensures that you adhere to best practices

advocated by the Financial Action Task Force (FATF) and

Joint Money Laundering Steering Group (JMLSG). Verifylab’s adaptive AI, combined

with our

automation and business rules, is designed to cut down the number of false positives

significantly. This allows your MLROs and compliance team to only focus on relevant

matches.

Adverse Media Reports

Our Adverse Media screening service is a powerful compliance tool that assists

businesses in anticipating and identifying risks to stay ahead of bad actors. The

global news landscape evolves quickly, and breaking stories often suggest that

customers and other parties pose an increased reputational or compliance risk ahead

of official confirmation. Build comprehensive risk profiles of your customers with

our adverse media screening service.

It covers more than 50,000 globally curated and highly trusted news sources.

Verifylab’s adverse media reports spans across media coverage and cases of

corruption, financial and tax crime, trafficking, director disqualifications, stock

exchange, official register disbarments, organized crime and much more. Protect your

customers and your organization with screening against more than 20,000 adverse

media sources during onboarding and beyond.

Watch List Screening

Our comprehensive coverage of global AML watchlist sources, instant results and flexible

automation features ensure that you effortlessly comply with the most stringent

regulations. Use our proprietary network to screen individuals and companies against

global watchlist sources from over 200 countries and territories. Verifylab’s data

points are growing every day to ensure you remain ahead of bad actors while exceeding

regulatory standards. Protect your customers and your organization with screening

against more than 6,000 global watchlists. and more than 20,000 adverse media sources at

onboarding and beyond.

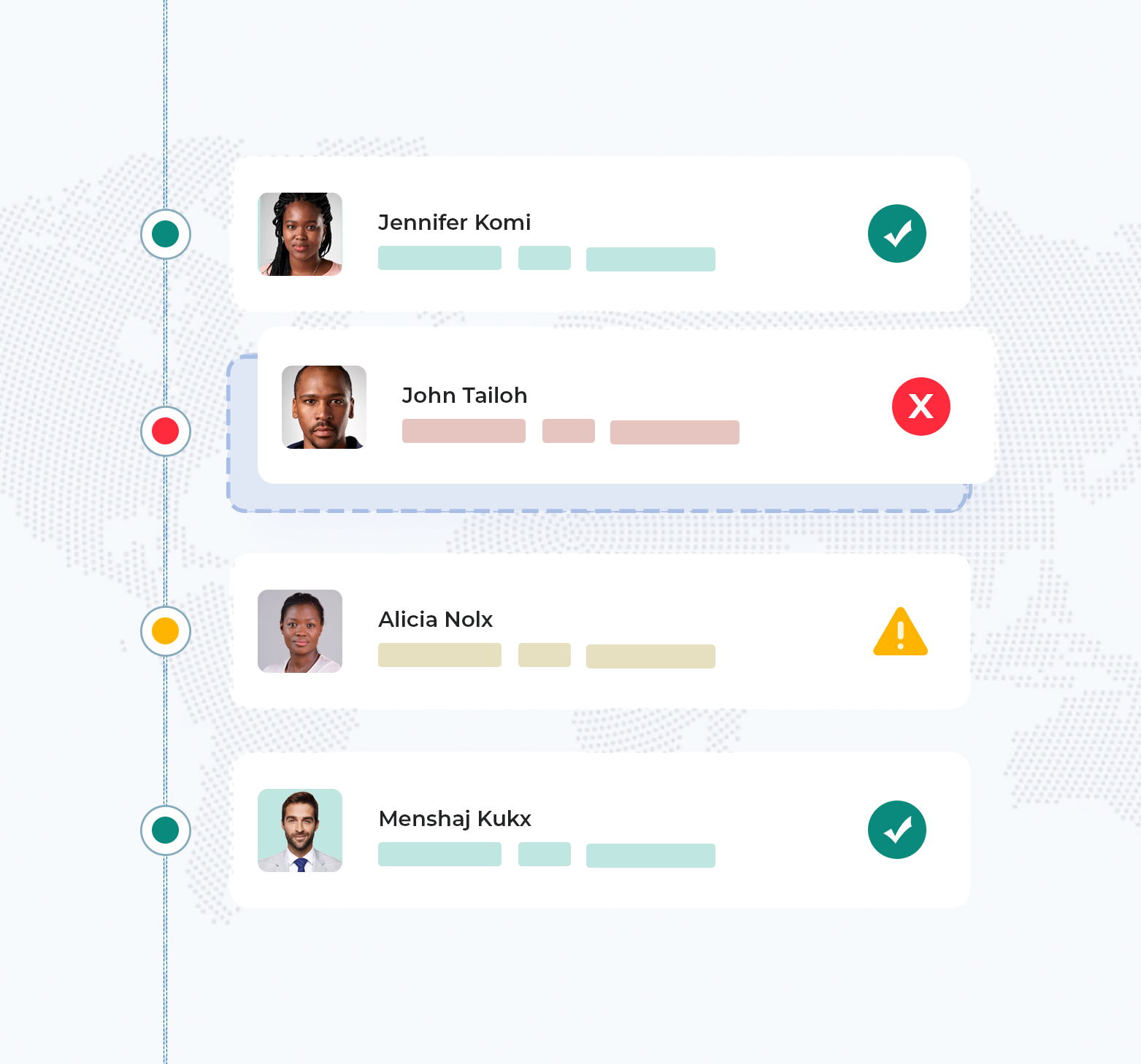

Continuous Monitoring

Flagging a customer means nothing until you are able to stay ahead and avert

complications before they blow out of proportion. Monitor your customers against our

sanctions, watchlists, PEP, and adverse media databases after you have onboarded them

with continuous AML and service monitoring. Verifylab’s state-of-the-art continuous

monitoring engine uses AI and high-performance computing to screen millions of customers

in real-time every day.

You receive emails and webhook notifications if a customer’s status changes. Our

responsive and automated continuous monitoring engine essentially never goes to sleep,

once a customer’s status is earmarked for monitoring. Be rest assured and confident in

the fact that you’re fully compliant while focusing on growing your business.

World Match Checks

We run your verified name from the submitted government ID and in -turn feed this data

into our World Match Checking Nodes and databases. The database encompasses an expansive

range of data, including but not limited to politically exposed persons (PEPs),

sanctions lists, watchlists, adverse media coverage and other relevant risk indicators.

This ensures that similar and near-exact names of your clients, available anywhere in

the world is generated in a split second to enable you access and decide on next steps.

The use of advanced AI and machine learning algorithms sifts through vast amounts of

data from a multitude of sources, ranging from official government publications and

databases and supporting news outlets. This constant vigilance enables financial

institutions to stay ahead of emerging risks and comply with evolving regulatory

requirements. We simply find customers, their clones and similar names.

Varied Opensource Data

We extend our data screening sources to open public data, consolidated local lists,

gazette databases, social media profiles, wikidocs, etc to present you complete digital

footprints of your prospecting customer. We give you enough data and metrics to enable

you take the best decision as a business owner and administrator. Get to know your

customer better and their conduct on the cyber space before settling on a decision.